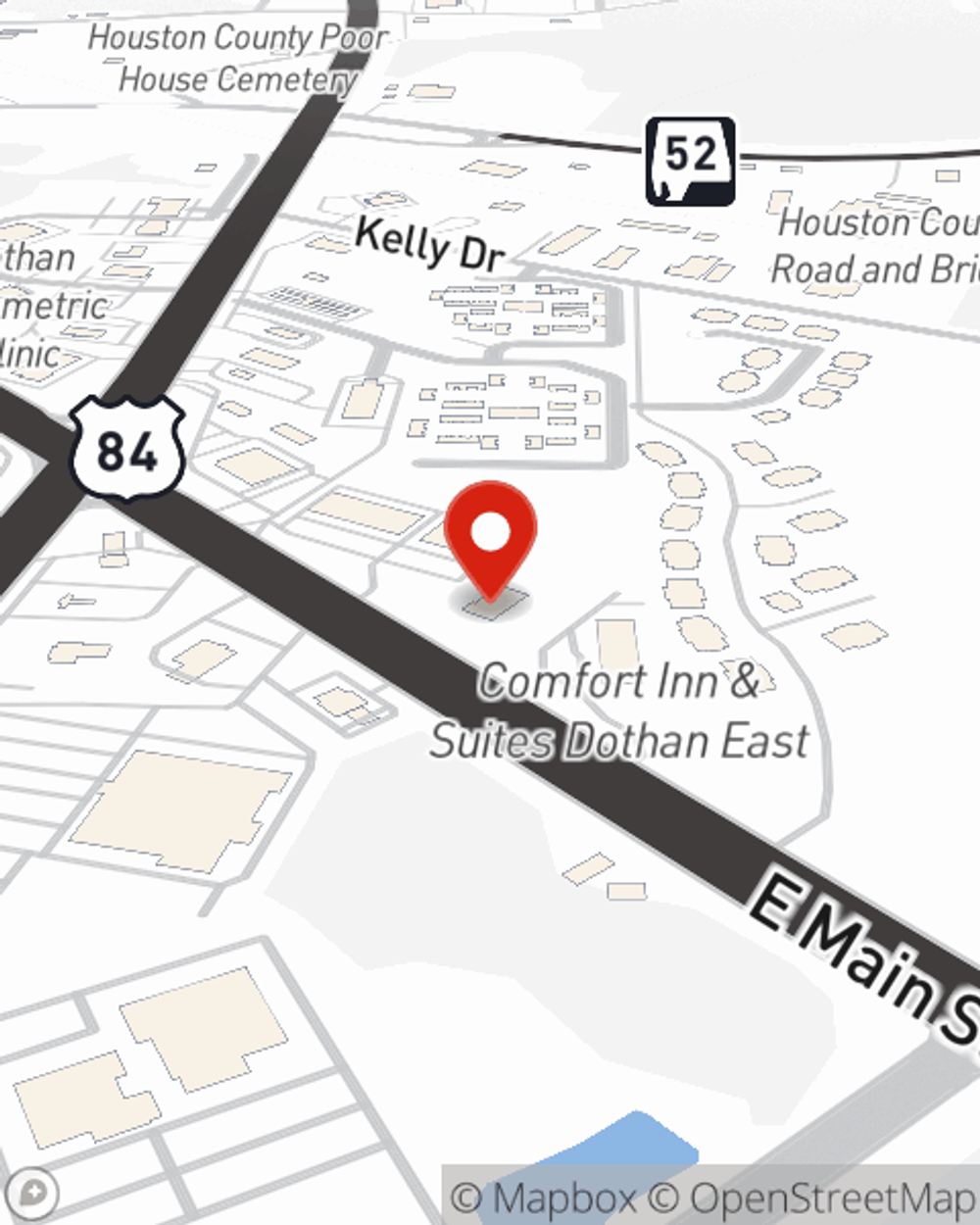

Life Insurance in and around Dothan

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

- Ashford

- Columbia

- Cottonwood

- Cowarts

- Slocomb

- Rehobeth

- Taylor

- Headland

- Geneva

- Hartford

- Webb

- Enterprise

- Ozark

- Daleville

- Abbeville

- Eufaula

- Brundidge

- Troy

- Pansey

- Gordon

- Newton

- Wicksburg

Check Out Life Insurance Options With State Farm

One of the greatest ways you can protect the people you're closest to is by taking the steps to be prepared. As pained as considering this may make you feel, it's good to make sure you have life insurance to prepare for the unexpected.

Get insured for what matters to you

What are you waiting for?

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less overwhelming for the people you're closest to and give time to recover. It can also help cover current and future needs like future savings, phone bills and car payments.

If you're looking for reliable insurance and caring service, you're in the right place. Talk to State Farm agent Wint Smith now to see which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Wint at (334) 446-0308 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.